In the dynamic world of finance, technology has been a transformative force, giving birth to an industry known as Fintech. Short for financial technology, Fintech is at the forefront of reshaping transactions, banking, investment, and even the way we interact with money itself. This comprehensive article delves into the essence of Fintech, exploring its evolution, key components, and the impact it has on the global financial landscape.

What is Fintech?

Fintech merges finance with digital innovation, aimed at improving and automating the delivery and use of financial services. It encompasses a broad range of applications, from mobile banking and peer-to-peer lending platforms to cryptocurrency and blockchain technology. Fintech is designed to make financial services more accessible, faster, and less expensive for both businesses and consumers.

The Evolution of Fintech

The journey of Fintech began in the 21st century with the introduction of internet banking, but it truly took off with the advent of smartphones and mobile internet. The financial crisis of 2008 also played a pivotal role, as it led to a loss of trust in traditional banks and created an opportunity for innovative startups to offer new, customer-focused solutions.

Today, Fintech has expanded beyond its initial focus on payments and loans, encompassing areas such as investment management, insurance (Insurtech), and financial planning. With advancements in artificial intelligence (AI), blockchain, and data analytics, Fintech is continually evolving, pushing the boundaries of what’s possible in the financial sector.

Key Components of Fintech

1. Mobile Payments and Banking

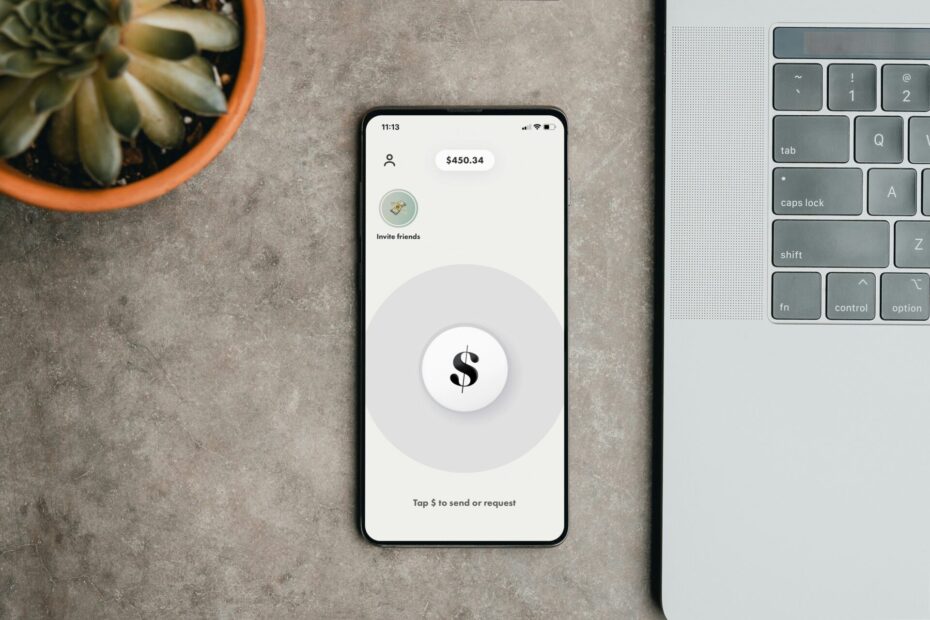

One of the most visible aspects of Fintech is mobile banking, which allows customers to manage their finances directly from their smartphones. This includes checking balances, transferring funds, and making payments without visiting a bank branch. Mobile payment systems like PayPal, Venmo, and Square have revolutionized how we pay for goods and services, emphasizing convenience and security.

Examples:

- PayPal: A global leader in online payment solutions, allowing users to send and receive money, make online payments, and manage their finances.

- Venmo: Popular among younger consumers, Venmo is a mobile payment service that makes it easy to share expenses and transfer money to friends and family.

- Stripe: Provides powerful and flexible tools for internet commerce, helping businesses of all sizes accept payments online and in mobile apps.

2. Peer-to-Peer (P2P) Lending

P2P lending platforms like Lending Club and Prosper enable individuals to lend and borrow money directly from each other, bypassing traditional financial institutions. This model offers lower interest rates for borrowers and higher returns for lenders, facilitated by algorithms that assess credit risk.

Examples:

- Lending Club: One of the first platforms to allow individuals to lend and borrow money directly from each other, bypassing traditional financial institutions.

- Prosper: A peer-to-peer lending platform that offers personal loans and investment opportunities, focusing on consumer credit.

3. Cryptocurrency and Blockchain

Cryptocurrency, with Bitcoin leading the charge, has introduced a new paradigm for digital currency and transactions. Blockchain, the technology underpinning cryptocurrencies, offers a decentralized and secure ledger for all transactions, promising to revolutionize everything from payment processing to supply chain management.

Examples:

- Ripple: Focuses on blockchain technology to enable secure, instant, and nearly free global financial transactions of any size with no chargebacks.

4. Robo-Advisors and Investment Apps

Fintech has also made investing more accessible. Robo-advisors, such as Betterment and Wealthfront, use algorithms to provide investment advice and manage portfolios with minimal human intervention. Investment apps like Robinhood democratize stock market access, allowing users to trade stocks without commissions.

Examples:

- Robinhood: Known for its commission-free trading, Robinhood offers trading in stocks, ETFs, options, and cryptocurrencies, appealing to a younger demographic of investors.

- Betterment: A leading robo-advisor platform that provides automated, algorithm-driven financial planning services with little to no human supervision.

- Wealthfront: Offers a range of investment management and financial planning services, including free financial planning, investment management, and lending products.

5. Insurance (Insurtech)

- Lemonade: Uses AI and chatbots to provide homeowners and renters insurance, promising fast claims processing and a portion of unclaimed money going to charities.

- Oscar Health: A health insurance company that uses technology, design, and data to humanize health care, offering easy-to-understand health insurance plans.

6. Personal Finance Management

- Mint: Offers online personal finance tools, allowing users to track their spending, create budgets, and monitor their financial health in one place.

- YNAB (You Need A Budget): Focuses on budgeting and financial planning, helping users to give every dollar a job and improve their financial literacy.

7. RegTech

Regulatory Technology refers to the use of technology to streamline and enhance regulatory processes within the financial industry. It aims to help companies comply with regulations efficiently and minimize risks through innovative solutions such as AI, machine learning, and blockchain.

Examples:

- Chainalysis: Provides blockchain data and analysis to governments, banks, and businesses to detect and prevent fraud and money laundering activities.

- ComplyAdvantage: Uses machine learning and artificial intelligence to help firms manage compliance obligations, monitoring for money laundering and terrorist financing.

Impact of Fintech

The implications of Fintech are profound and far-reaching. For consumers, it offers convenience, reduced costs, and personalized financial services. Small businesses benefit from easier access to capital and financial management tools. For the traditional banking sector, Fintech presents both challenges and opportunities for innovation and collaboration.

However, the rapid growth of Fintech also raises regulatory and security concerns. As Fintech companies handle an increasing volume of sensitive financial data, protecting against cyber threats and ensuring data privacy become paramount. Regulators worldwide are working to strike a balance between fostering innovation and protecting consumers and the financial system.

The Future of Fintech

The future of Fintech is bound to be shaped by emerging technologies like AI, machine learning, and the continued growth of blockchain. These innovations promise to make financial services even more personalized, efficient, and secure. As Fintech companies continue to collaborate with traditional banks and financial institutions, a more integrated and customer-centric financial ecosystem is emerging.

Fintech is not just a buzzword; it’s a revolutionary movement that is changing the face of finance. By harnessing technology to simplify and enhance financial services, Fintech is making the financial world more accessible and efficient for everyone. As we look ahead, the potential of Fintech to further innovate and democratize finance is limitless, promising a future where financial services are more inclusive, transparent, and aligned with the needs of the digital age.

If you’re interested in building a Fintech platform, consider reaching out to Enozom Software. Enozom is a software development company with experience in delivering various custom platform. we provide a range of services from design and development to integration and deployment, ensuring your platform meets industry standards and leverages the latest in financial technology.